ICOs are becoming funds – TechCrunch

What does a startup do with $48 million? $130 million? $1.7 billion? This question – one integral in the whole ICO craze – hasn’t quite been answered yet but it’s going to be far more interesting as ICOs and cryptocurrencies transform from purely product-oriented companies into actual funds.

Take the news that the creator of the TRON token bought BitTorrent for $140 million purportedly to lend legitimacy to the platform. “One shareholder we spoke to says there are two plans,” wrote TechCrunch’s Ingrid Lunden. “First, it will be used to ‘legitimize’ Tron’s business, which has met with some controversy: it has been accused of plagiarizing FileCoin and Ethereum in the development of its technology. And second, as a potential network to help mine coins, using BitTorrent’s P2P architecture and wide network of users.”

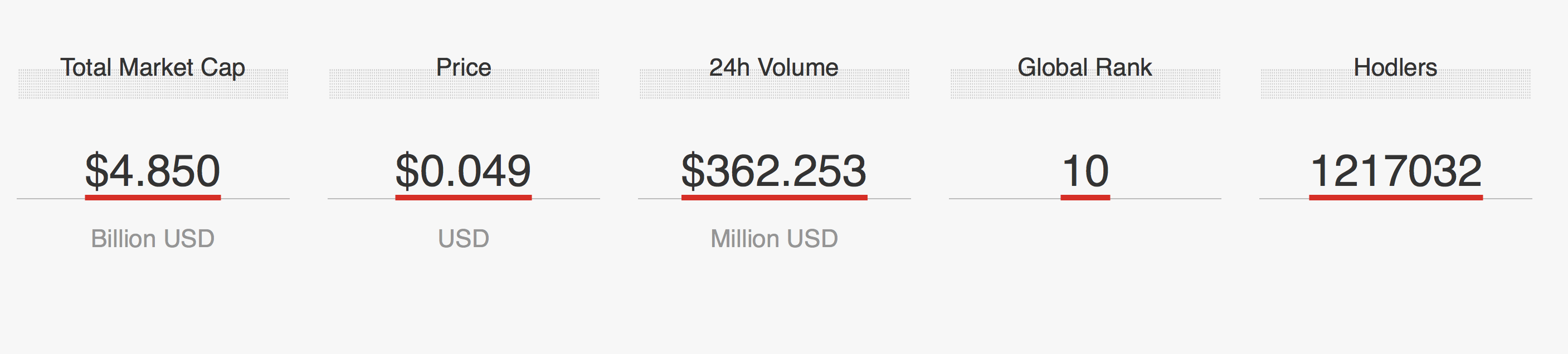

Given a $4.8 billion market cap, the cost of buying a beloved network brand, even one as tainted by controversy as BitTorrent, is miniscule. Further, it allows TRON to fill its war chest with solid businesses even as its own efforts end laughably with ham-handed announcements about non-existent partnerships and failed pumping by the idiosyncratic John McAfee.

In short, all of those massive ICO raises aren’t going to Aeron chairs and food truck rodeos in the company parking lot. Those smart enough to machinate their way into an ICO raise aren’t interested in product, no matter what they claim. They are interested in becoming investors, gobbling up products and people in order to gain a stranglehold on the space. Further, these ICOed organizations are often already registered as broker-dealers in various jurisdictions and have all of the legalities in place to take and invest large sums of cash. In short, if you think any successful ICOed company will deliver actual product before it would buy itself into multiple iterations of that same product I have a few tokens to sell you.

Startups start small for a reason. None of the current crop of successful ICOs have any technical merits, no matter how dense their white papers. While PhDs and computer scientists have great ideas, ultimately their ideas fail when dashed against the realities of the market. Most startups die because they are underfunded but they are underfunded because the risk associated with their ideas are far too high to ensure a win.

ICOs on the other hand are wild bets that a person who is connected to the crypto space will know better what to do with unearned crypto riches than the owners of those riches. It is a bet that the ICOing org is willing to work a little harder to make 10,000 Ether or a few hundred Bitcoin pay off in the long run and it’s a bet that the congregation of all that crypto wealth will bring the true sharks out to help turn a small investment into a big one. And you never get rich releasing a single product. You get rich buying and controlling multiple products.

The other important consideration? VCs will soon find themselves fighting for deals with ICOed companies. While it won’t happen soon and perhaps the big houses won’t feel it at all, expect smaller VCs to lose LPs as those LPs dump their cash into Maltese ICOs and not Sand Hill Road. It’s an interesting and overdue turnaround.

Cool read from TC Source Link

Comments

Post a Comment